drive by appraisal fannie mae

Forget drive by appraisals. Fannie Mae Freddie Mac relax appraisal employment verification standards in wake of coronavirus.

1024 Fannie Mae And Freddie Mac Covid 19 Temporary Appraisal Flexibilities Explained

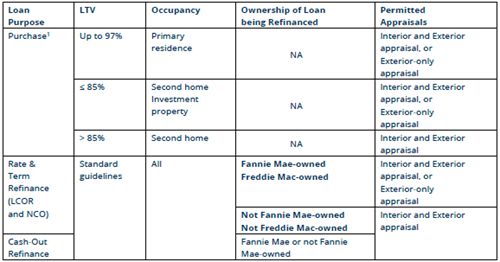

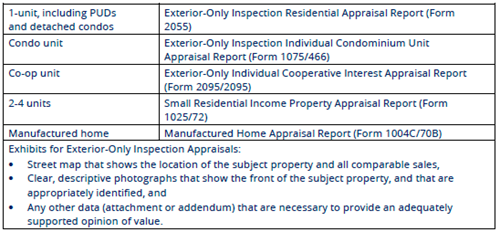

While appraisers often use Fannie Maes Uniform Residential Appraisal Report in traditional home appraisals there is also an Exterior.

. For a Fannie Mae Freddie Mac 1004 Desktop Appraisal to be valid the appraiser must have a Floor Plan which shows all interior walls to help assess the functional utility of the home. ANSI Z765-2021 American National Standards Institute Measuring Standard for measuring calculating and reporting gross living area GLA and non-GLA areas of subject. With the new FHFA changes through Fannie Mae and Freddie Mac Desktop and Drive-by appraisals will be helpful to appraisers during the Covid-19 pandemic.

The Federal Housing Finance Agency FHFA announced on Thursday it has extended relaxed lending and appraisal standards put in place due to COVID-19 another month for both Fannie Mae and Freddie. Drive-by appraisals are also called exterior-only appraisals. The Federal Housing Finance Agency announced this morning that it is instructing Freddie Mac and Fannie Mae to use alternative home appraisal methods until May 17.

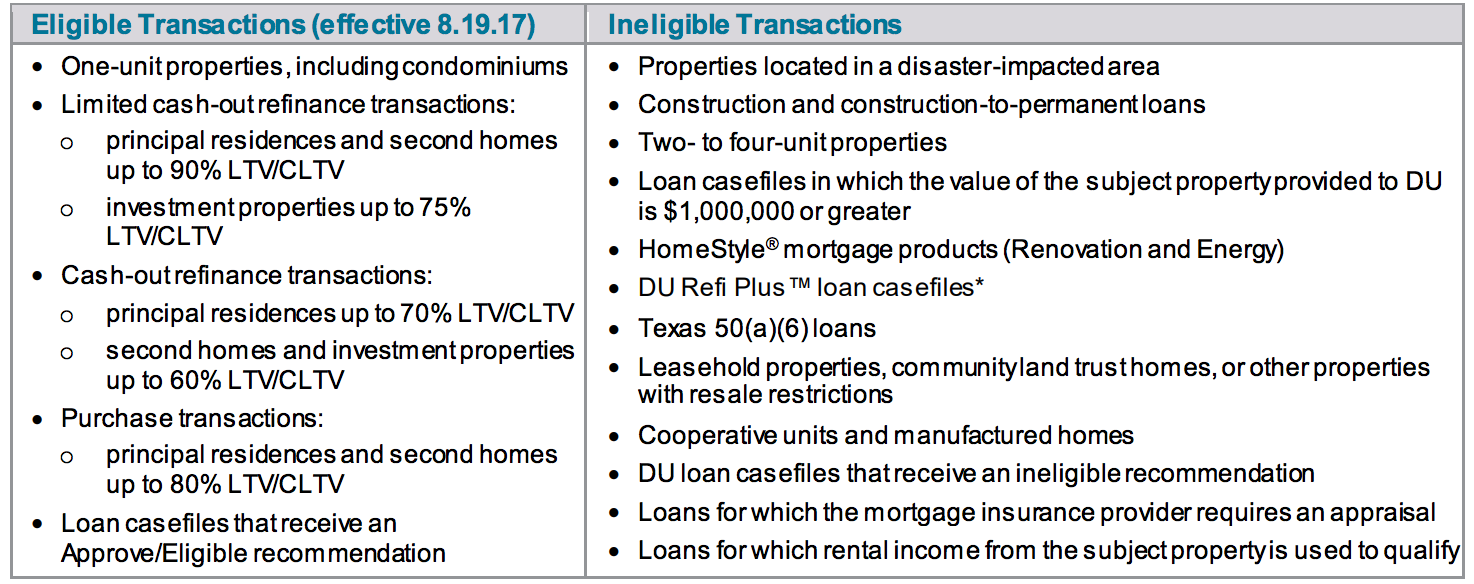

Fannie Mae and Freddie Mac will accept desktop appraisals for home purchases. In order to continue to offer Conventional financing and meet the requirements of our agreement with Fannie Mae going forward we will require Originating Lenders to share appraisal data through Fannie Maes UCDP for all Virginia Housing. Will allow drive-by and desktop.

Well be adding information to the fact sheet such as additional FAQs as needed. While we know appraisers are familiar with Drive-bys and Desktop appraisals we thought it would be. Although the scope of work for the appraisal or the extent of the appraisal process is guided by Fannie Maes appraisal report forms the forms do not limit or control the appraisal process.

Forget appraisers price gauging homebuyers especially in rural regions. Major mortgage organizations like Fannie Mae believe homes for sale are more likely to have updated and accurate information and pictures in appraisal databases than homes that have been off the market for years. Watch one of Fannie Maes Boot Camp webinars to see how we discuss appraisal risk with lenders.

This temporary guidance provides certain flexibilities to their respective existing appraisal and property. Boot Camp Webcast Series. Loans Fannie Mae requires that the lender obtain a signed and complete appraisal report that accurately reflects the market value condition and marketability of the property.

Drive-by appraisals are cheaper than traditional appraisals which can typically cost 300 400. The appraisers analysis should go beyond any limitations of the forms with additional comments and exhibits being used if they are needed to. Appraisers will be required to use the Square Footage-Method for Calculating.

The appraisers opinion of value as written in his or her appraisal report should reflect the fair market value of the property -- what a willing buyer would pay a willing seller in an arms-length transaction. Drive-By Appraisal Advantages. Beginning March 19 Fannie Mae will add desktop appraisals as an option for.

On December 15 2021 Fannie Mae announced that it will be adopting ANSI Measuring Standard in 2022. On March 23 2020 Fannie Mae and Freddie Mac under the guidance of FHFA released temporary guidance regarding appraisals and property valuations in response to the COVID-19 national emergency. To access the Boot Camp Webcast Series.

Although the scope of work for the appraisal or the extent of the appraisal process is guided by Fannie Maes appraisal report forms the forms do not limit or control the appraisal process. Drive-by appraisals are also called exterior-only appraisals. In the past Virginia Housing occasionally required appraisals to be shared through Fannie Maes Universal Collateral Data Portal UCDP.

Fannie Mae defines a sketch as typically displaying only exterior dimensions. Bob Murphy Founder of Collateral Advisors LLC. GSE Drive-by Appraisals COVID -19 OVERVIEW Introduction.

Drive-by appraisals can save time and hassle especially for refinancing or home equity loans. Today Fannie Mae updated its Lender Letter LL-2021-04 Impact of COVID-19 on Appraisals communicating to its single-family sellers that the effective date of this lender letter is extended to May 31 2021. This session includes tips lenders can use to manage appraisal risk in both origination and QC as well as examples of common appraisal defects to watch for.

Because an appraiser isnt entering the home these types of appraisals are more convenient for homeowners who dont have to worry about prepping their home or planning their schedule around the appraisal. Fannie Mae Updates Temporary Appraisal Policies in Response to COVID-19 Emergency. Until further notice Fannie Mae is temporarily providing flexibility with respect to the completion of property inspections including inspections for properties securing a delinquent mortgage loan as described in Servicing Guide D2-2-10 Requirements for Performing Property Inspections and inspections related to hazard loss repairs as.

Freddie Mac Form 2055 March 2005 This form was reproduced by United Systems Software Company 800 969-8727 - Page 1 of 6 Fannie Mae Form 2055 March 2005 Lincoln Appraisal Group Page 1 drive by single family. Some loans may be eligible for an appraisal waiver and an appraisal is not required if the lender exercises the waiver and complies with the related requirements. This fact sheet provides high-level information on Fannie Maes requirements for desktop appraisals and answers some frequently asked questions.

Fannie Mae and Freddie Mac will accept desktop appraisals for home purchases. Get Free Fannie Mae Property Preservation Guidelines netasgov If a public agency has a financial or real property interest in the proposed project the application must either include the public agency as a co-applicant or otherwise include a commitment to enter into a contractual agreement to develop the. Beginning in March 2022 desktop appraisals will be an option for some loan transactions.

After May 31 LL-2021-04 will no longer apply with. Fannie Maes form for this type of appraisal is its 2055 so you may hear a drive-by referred to as a 2055 Fair market value. Josh Walitt Principal Consultant for Walitt Solutions.

Drive-by appraisals can save time and hassle especially for refinancing or home equity loans.

Fannie Mae Freddie Mac Relax Appraisal Employment Verification Standards In Wake Of Coronavirus Housingwire

Announcement 2020 026 Covid 19 Coronavirus Guidance Newrez Correspondent

Fannie Mae Freddie Mac Relax Appraisal Employment Verification Standards In Wake Of Coronavirus Will Allow Drive By And Desktop Appraisals In Certain Circumstances The Bee The Buzz In Bullhead City Lake

Fannie Mae And Freddie Mac Adopt Alternative Home Appraisals Due To Coronavirus

Announcement 2020 026 Covid 19 Coronavirus Guidance Newrez Correspondent

Announcement 2020 026 Covid 19 Coronavirus Guidance Newrez Wholesale

Appraisals Undervalue Refis For Black Borrowers Fannie Mae National Mortgage News

What Is A Drive By Appraisal Mortgages And Advice Us News

The Fannie Mae Requirement Impacting All Appraisers In 2022 Appraisal Buzz

Announcement 2019 104 Conventional Conforming Fannie Mae Product Updates Newrez Correspondent

Fannie Mae S Cu Is Here Appraisal Buzz

Fannie Mae Freddie Mac Relax Appraisal Employment Verification Standards In Wake Of Coronavirus Housingwire

Announcement 2020 026 Covid 19 Coronavirus Guidance Newrez Wholesale

Best Practices For Desktop And Drive By Appraisals During The Coronavirus Appraisal Buzz

1004d Appraisal Update Vs Completion Certification Final Inspection What Is The Difference Dart Appraisal

Everything You Need To Know About Fannie Freddie Appraisal Free Purchase Mortgages Housingwire